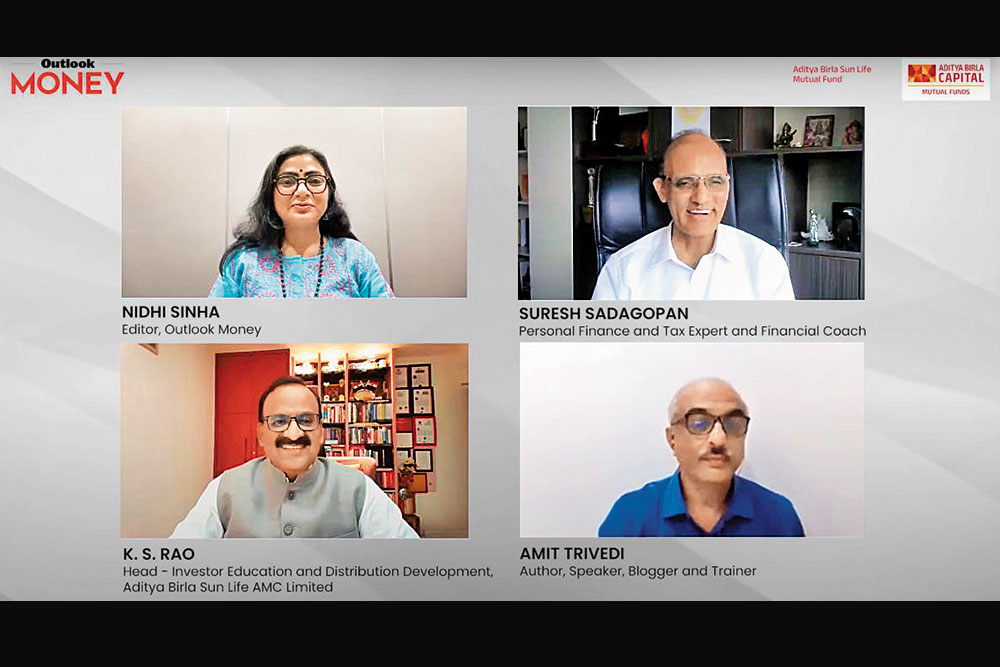

The latest webinar in the investor education and awareness series by Aditya Birla Sun Life Mutual Fund, in association with Outlook Money, tackled the crucial topic of “Smart Money Habits to Achieve Financial Success”. The discussion featured insights from K.S. Rao, Head of Investor Education and Distribution Development at Aditya Birla Sun Life AMC, Amit Trivedi, Co-founder of OSAT Knowledge Pvt. Ltd, and Suresh Sadagopan, Sebi-Registered Investment Advisor and Founder of Ladder7 Financial Advisories. The session was moderated by Nidhi Sinha, Editor, Outlook Money. Here are some key habits that the experts highlighted. Edited excerpts:

Start Small

Rao emphasised the importance of starting with small steps. “The first step is crucial. As Dr. Abdul Kalam said, ‘You cannot change your future, but you can change your habits.’ Starting with a simple habit like budgeting can have a significant impact,” he said.

Echoing the sentiment, Trivedi highlighted that financial habits should be developed one step at a time. “Remember that even if you start saving just 5 per cent of your income, it can grow to 30 per cent over time. It’s all about forming that initial habit,” he said.

Have Family Conversations

Sadagopan stressed the need for open discussions within families about financial goals and habits. “Financial success is a family pursuit. It’s essential to have regular conversations and align on what financial success means for everyone in the family,” he said.

Balance Now And Then

Trivedi addressed the common concern of balancing current enjoyment with future savings. “Financial goals are deferred spending. It’s not about saving versus spending; it’s about spending now versus later. Prioritise your financial goals and balance them with your current lifestyle,” he said.

Avoid Common Mistakes

Sadagopan pointed out typical mistakes, such as buying a house too early or thinking of financial planning in terms of products rather than holistic goals. “Financial planning is not about accumulating products but about setting and achieving personal financial goals,” he said.

Maintain Financial Discipline

Rao recommended using tools like systematic investment plans (SIPs) to inculcate financial discipline. “SIPs are a great way to start saving and investing regularly, leading to long-term financial success,” he said.

In conclusion, the speakers agreed that it is important to hire a financial advisor to plan your finances properly. Rao summarised it well: “Have an advisor to build investments and move towards wealth creation. Advisors provide the necessary guidance to stay on track with your financial goals.”

The webinar concluded with a reaffirmation that adopting smart money habits can significantly impact one’s financial success. Sinha highlighted: “It’s never too late to start adopting smart money habits. These habits can ensure a secure financial future for you and your family.”