The success of freemium software products like Slack, Zoom, and Dropbox has created a wave of interest in product-led growth (PLG) — a go-to-market strategy that primarily relies on the product to drive customer acquisition, retention, and expansion.

It represents an alternative to sales-led growth (SLG), the more traditional approach to selling software, where the Sales team is the primary driver of customer acquisition, retention, and expansion.

When fully embraced by every team in a software company, PLG can result in massive user and revenue growth. But it almost always fails when implemented as a siloed experiment in the product — i.e., by just adding a free trial onto an SLG model.

In this article, we’ll unpack the differences between PLG vs SLG, discuss the strengths and weaknesses of each go-to-market (GTM) strategy, and explain why you can’t implement PLG without getting buy-in from every team in your company.

The key differences between sales-led vs product-led

PLG is often mistaken for being a free trial or freemium model. And while it’s true that some form of a self-serve model is a key part of a PLG strategy, that’s only one difference between the two strategies.

Switching to product-led actually requires a shift in the role of each team. Without this — if a sales-led company simply slaps a free trial onto the website — the chances of successfully implementing a product-led approach are, in our experience, extremely slim.

SLG strategic alignment: All teams focus on selling the product

In sales-led growth, the teams are often siloed.

In SLG, Sales, Marketing, and Customer Success drive business growth, and the other teams play a supporting role.

Here are their roles and responsibilities:

- Marketing: Attract potential buyers to your product to drive leads.

- Sales: Find prospects and demonstrate the value of the product to them to convince them to buy.

- Customer Success: Teach paying customers how to succeed with the product and upsell existing customers.

- Product: Design features that will help the Sales team close more deals.

- Engineering: Build features that help the Sales team close more deals.

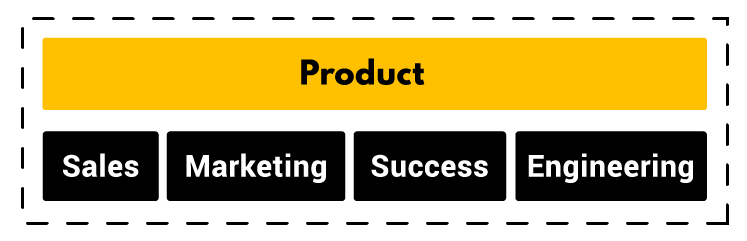

PLG strategic alignment: All teams focus on ensuring user success

In product-led growth, every team is organized around driving success for users of the product.

The idea is that user success will ultimately result in company success — by bringing in more and/or larger deals.

- Marketing: Attract potential users to your product and drive trials.

- Sales: Find power users of your product and help them achieve even more with an upgrade.

- Customer Success: Help new users reach your product’s value as fast as possible and with as little help as possible.

- Product: Understand how actual users succeed with the product and design a user experience that helps them achieve it.

- Engineering: Build or perfect features that help real users succeed.

These operational differences lead to unique strengths and weaknesses for each growth strategy.

Evaluating the pros and cons of PLG and SLG

A careful look at PLG versus SLG helps you understand the differences, making it easier to decide what's best for your product-focused business.

Below is a snapshot comparison of these GTM strategy strengths and weaknesses.

Now, let’s get into the graphic bullet points, starting with what makes these growth strategies desirable for some SaaS founders.

Key PLG strengths

The number one strength of a PLG strategy is the ability to lower your operational costs by lowering your customer acquisition costs (CAC).

The self-service sales model of PLG means you don’t have to pay a sales commission for each customer, and you can leverage scalable growth channels like organic SEO to acquire new customers, where a one-time investment can generate long-term returns.

Here are some of the other strengths of a PLG strategy:

- Scalability: You can serve more customers with a relatively small product-led team.

- Virality: You’re more likely to achieve virality and grow by word-of-mouth with a free product.

- Relevance: Many customers prefer to evaluate a product on their own instead of waiting for a sales demo.

Key SLG strengths

The primary benefit of SLG is the ability to close bigger deals, leading to a higher average ACV.

Sales teams can cater to the needs of enterprise customers by offering custom packages and even adding new features and integrations. With a few high-value accounts in the mix, a company can turn a profit with a much lower customer count than with PLG.

Here are some of the other strengths of SLG:

- Retention: The personal relationship between the sales rep and the customer can lead to lower churn because the salesperson can customize the demo to each customer’s use case and pain points.

- Pricing: You can keep your pricing private and raise or lower it on the fly (and charge different customers different rates).

- Traction: Sales teams can use tactics like cold calling and emailing to find and nurture leads from day one, while marketing tactics like SEO typically take months to become effective.

Key PLG weaknesses

The most obvious challenge of a PLG strategy is that some of your customers won’t ever pay you anything. Supporting your free users comes at a cost, providing adequate server space for many users and dealing with support tickets.

Here are some of the other weaknesses of a PLG strategy:

- Traction: Customer acquisition rests entirely on your marketing team, and gaining initial traction can be a huge barrier for startups.

- Retention: Getting customers to find value in your product without a human showing them how to use it can be challenging, which can lead to low free-to-paid conversion rates.

- Revenue: Serving small and medium businesses typically results in a lower average annual contract value (ACV), meaning you need to reach more customers to make a profit.

- Pricing: A PLG strategy requires transparent pricing to make it seamless for customers to upgrade to paid on their own, but this means you’ll have less freedom to experiment with customers’ willingness to pay.

Key SLG weaknesses

The biggest downside of SLG is the cost of the Sales team.

With the longer sales cycles and the fixed costs of generating enough leads to sustain a sales motion, SLG leads to an unsustainably high CAC. If your competitors adopt a PLG strategy, they’ll be able to undercut your prices if you’re still relying primarily on traditional sales.

Additionally, here are some other weaknesses of the SLG model:

- Scalability: In SLG, you need to scale up your team in proportion to customer growth.

- Pipeline: Companies typically see a much lower conversion rate from website visitors to demo requests, leading to fewer qualified leads and a much smaller sales funnel than in PLG.

The power of product-led sales

While the PLG vs. SLG debate often centers around overarching growth strategies, it's crucial to recognize the role of effective product-led sales (also known as the hybrid model) within a product-led growth model.

Product-led sales is not merely an extension of SLG but a unique approach that harmonizes with the principles of PLG.

Traditionally, software sales involved lengthy demos, focusing on telling users about product benefits. Modern SaaS companies now offer direct product access, concentrating on user success to prompt easy upgrades.

Product-led sales integrates self-serve principles with targeted sales outreach to high-touch accounts. Strategic timing of sales engagement ensures a seamless user experience, closing the gap between perceived and experienced value, which drives conversion.

Now that we’ve thoroughly covered the differences between PLG and SLG, and explored the intricacies of product-led sales and its integral role in the product-led model, let's transition into the decision-making process for SaaS companies evaluating the most suitable growth strategy.

4-factor decision flowchart for choosing a GTM strategy

PLG and SLG offer compelling advantages and considerable risks. The choice between them is not always obvious.

To help in this choice, we’ve developed a decision framework based on four factors:

- The complexity, dynamics, or newness of the problem and/or solution

- The ease with which customers can set up the product and start seeing results

- How you connect with the buyer and user — whether top-down or bottom-up

- How you win in your market

By applying these four factors, our flowchart helps you determine the right GTM strategy for your SaaS business, taking into account buyer personas and product-market fit.

The flowchart above is meant as a general guide.

What works for one company may not work for another. If you’d like guidance on choosing the right GTM roadmap for your business, check out the ProductLed coaching program.

Additionally, you’ll want to read my comprehensive guide on selecting a SaaS go-to-market strategy, offering an even more detailed exploration of my decision framework.

Examples of PLG and SLG models

Let’s examine examples of SaaS businesses employing each model and explore why they might have made that decision.

PLG examples

1. 7Shifts: Simplifying scheduling for restaurants

7shifts is an employee scheduling software expressly designed for the restaurant industry.

They’re in a competitive, well-established niche (employee scheduling software has been around for several years), and the value of the product is easy to understand without a one-on-one demo. You can get up and running in minutes, giving it a short time-to-value.

Restaurants tend to operate on razor-thin margins, so a product catering to restaurants needs to keep its pricing affordable. The lower costs associated with a PLG approach help 7shifts achieve profitability without pricing themselves out of their target market’s reach.

2. Softr: Empowering non-technical teams

Softr is a no-code web application builder known for helping non-technical teams build client portals, internal tools, and marketplaces. The value proposition of the tool is the ability to build interactive websites and web applications without coding skills.

To experience the value of their product, you not only have to build a website or app (which can take weeks or months), but you also have to see other people interacting with it. It would be almost impossible for a salesperson to demonstrate this value in a call. Most users would need to try it out for themselves and see if they can learn the interface and produce websites they’re proud of before being willing to pay.

These are likely some of the reasons Softr has chosen to offer a free version of the product for individual users, as well as a 30-day trial for its paid plans.

3. Shopify: Revolutionizing e-commerce

Shopify is one of the biggest e-commerce platforms in the world, and they’ve achieved tremendous growth by helping entrepreneurs build new e-commerce businesses from scratch.

One of Shopify’s key value propositions is the ability to spin up a functional online store in minutes. Having to request a demo with a salesperson would introduce a ton of unnecessary friction to the user journey and harm that value proposition.

By eliminating the need to hire a team of developers to build your e-commerce store, Shopify is disrupting its niche and setting itself up to use a dominant strategy to win market share. To make the numbers work as competitors enter the market, keeping CAC to a minimum is important.

SLG examples

1. Use Insider: Tailored marketing automation for large retailers

Insider is a marketing automation platform specializing in website personalization and cross-channel campaign management.

They target large retailers with complex use cases, making a Sales team crucial for helping prospects understand the value of the product and how it compares to competitors.

2. Bynder: Streamlining digital asset management

Bynder is a digital asset management (DAM) platform with an easy-to-use interface. Since every department in a company creates digital assets and may need to access them for different reasons, DAM solutions are typically very complex and often require custom features.

Additionally, migrating to a new DAM is a time-consuming process involving cooperation from multiple teams. It would be nearly impossible to experience the value of Bynder during a free trial, and the price point of DAM solutions is high enough that there’s much less need to minimize CAC than in other software niches.

3. Procore: Elevating construction management

Procore is a construction management platform that helps large construction companies track the status of projects from bidding to completion. Migrating to a new project management platform is a huge — and expensive — undertaking for construction companies, so prospective buyers expect a white-glove experience.

A sales-led model must meet customers’ expectations and adequately demonstrate the product's value.

How to implement a PLG strategy the right strategy

Your choice of growth strategy has a lot of downstream effects on your overall business strategy, your organizational structure, and your positioning in customers’ minds.

If you’re a sales-led company facing pressure from rising CAC and/or reduced willingness to pay, switching to a product-led growth model could put you back on track toward profitability.

However, like many large-scale transformation efforts, how you approach the change will affect how successful your outcomes are.

You can’t hire a consultant to set up your free trial, design your pricing, or streamline your onboarding.

Switching to product-led isn’t a one-time fix.

Successfully implementing PLG requires a mindset shift across your entire company. If you don’t get buy-in from your whole team from the beginning, you’ll face an uphill battle at every step.

Over 95% of B2B SaaS CEOs who reach out to us have hit a plateau with their product-led growth motion. This happens because:

- They have an unintentional model. Many SaaS companies opt for a free trial or freemium model simply because their competitors do it. However, there are multiple product-specific, company-specific, and market-specific factors to consider. A structured decision-making framework is essential; you can't rely solely on intuition.

- Their approach is surface-level. Do you think you can excel in a marathon just by buying expensive shoes without focusing on diet and training? Similarly, many companies adopt a free trial or freemium model without building the necessary capabilities to support their product-led motion. This superficial approach is a recipe for disaster.

- They're solving the wrong problem. I've seen hundreds of scenarios where companies spend months optimizing their onboarding flow to improve free-to-paid conversion rates, only to realize later that the issue lies with their offer. Most companies don’t have the luxury of time to make such mistakes.

If you're struggling with choosing the right model, I've created a framework to help you solve these challenges. We guide founders through this framework in ProductLed's coaching program. Building a strong strategy is the first of nine components we tackle in our three-phase system, designed to help product-led companies scale more efficiently and profitably than ever before.