T-Mobile phone insurance: Everything you need to know

Get the best protection and security for your premium device.

As one of the three biggest wireless carriers in the country, T-Mobile offers a diverse range of feature-packed cell phone plans. And of course, the 'un-carrier' also lets you choose from a plethora of phones to get the most out of those plans. That's all great, but if you really want to have the best experience as a customer, we suggest taking a look at T-Mobile phone insurance as well.

T-Mobile offers two plans offer under its 'Protection<360>' insurance program, and these not only let you keep your pricey device(s) protected against any and all kinds of damage, but also make you eligible for some upgrade-related perks. To help you make the right decision, we've detailed everything there's to know about the service.

What is it?

What T-Mobile phone insurance really is?

Why you can trust Android Central

No matter how careful we are with our devices, accidents can (and do) happen. And considering how expensive (majority of) modern-day smartphones are, it's important to keep them protected. This is exactly what T-Mobile's phone insurance program is designed to help you with. It's pretty similar to what the carrier's competitors AT&T and Verizon also offer, so do check them out if you're a customer of either of those two.

As mentioned before, there are two plans offered under T-Mobile's Protection<360> service. These are mentioned below:

- Insurance Device Protection Plan: This includes coverage for accidental damage, loss, and theft.

- Service Contract Device Protection Plan: This involves coverage for hardware issues, upgrades, screen protector replacements, tech support, and mobile security.

Who can enroll?

Who can enroll in T-Mobile phone insurance?

The first thing to note is that T-Mobile's phone insurance plans are only available for postpaid customers. If you're one, you can add Protection<360> while purchasing a new device and/or activating it on the carrier's network. Although you can also do it later, it must be done within 30 days of the device's purchase/activation. The service requires your device to pass a physical and mechanical inspection, carried out in a T-Mobile store.

Note: As part of a limited-time 'Open Enrollment' promotion active till June 26, 2024, you can sign up for Protection<360> regardless of your device's date of purchase.

Insurance plans and their costs

How much does T-Mobile's phone insurance cost?

Depending on the type of device, T-Mobile's Protection<360> phone insurance will cost you $7-25 per month, excluding any applicable taxes. For New York customers only, Protection<360> includes both plans (Insurance Device Protection and Service Contract Device Protection). However, they can be bought separately too. If you're a New York customer and purchase both plans, you'll get a discount of up to $1.50 on the Insurance Device Protection plan, based on your device's tier. You can avail this discount even if you've bought your device from another provider, provided you can show proof of service contract.

You'll be charged a service fee/deductible (plus tax) based on the tier of your device, after your claim is approved. You can file up to five accidental damage, theft, or loss claims in any rolling 12-month period. However, there's no limit on hardware service (mechanical breakdown) claims.

Benefits

What are the advantages of T-Mobile phone insurance?

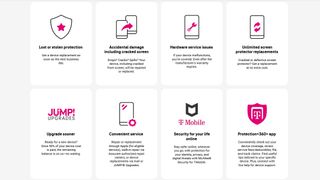

Protection<360> is T-Mobile's extensive phone insurance program that comes with a whole lot of perks as mentioned below:

- Coverage for accidental damage.

- Replacement of lost or stolen devices.

- Repairs or replacements for hardware service (e.g., mechanical breakdown) issues.

- Screen repair through service provider's (Assurant) network.

- AppleCare eligibility for Apple devices during the first 24 months of enrollment into the program.

- Eligibility to upgrade to via JUMP! program for devices on Equipment Instalment Plans (EIP), when 50 percent of their cost has been paid.

- McAfee Security for T-Mobile for safe browsing, malware protection, identity theft, lost wallet protection, and more.

- App-based claim filing and tracking, and live technical support for connected devices like routers, game consoles, and smart TVs.

- Unlimited in-store replacements for broken or defective screen protectors. This does not include liquid glass screen protectors.

Filing claims

How to file a claim?

All Protection<360> insurance claims are handled by Assurant, so you can go to the link — T-Mobile Premium Handset Protection | Assurant — and get started. As an alternative, you can also call Assurant at 866.866.6285 or use the 'Protection<360>' app to file the claim. You'll be needing the following details for the process:

- Details (e.g., make, model) of the lost/stolen device and information explaining what happened to it.

- Contact information. This is usually your T-Mobile account's user ID and password. You may also be asked to present a picture ID.

- Payment method for service fee/deductible.

- Shipping information (for domestic US use only).

Should you get it?

Is it worth getting T-Mobile phone insurance?

The best T-Mobile cell phone plans offer everything from super-fast 5G access to bundled streaming services, but they're certainly not cheap. What's more, you need a top-tier smartphone like the Samsung Galaxy S24 Ultra if you want to get the best experience with the un-carrier's feature-packed plans. And this is exactly why getting T-Mobile phone insurance makes sense.

Sure, it'll bump up your monthly wireless bill by a few dollars, but that's a small price to pay for making sure your premium device stays protected from any and all kinds of damage. Moreover, you'll also get additional benefits like unlimited replacements for screen protectors, malware protection, and more. So, unless you're one of those extremely careful individuals who go the extra mile to keep their devices in flawless condition, you'll find T-Mobile's Protection<360> insurance program to be absolutely worth it.

Be an expert in 5 minutes

Get the latest news from Android Central, your trusted companion in the world of Android

When Rajat got his first Personal Computer—a Pentium III machine with 128MB of RAM and a 56kbps dial-up modem—back in 2001, he had little idea it would mark the beginning of a lifelong love affair with gadgets. That fascination, combined with a penchant for writing and editing, ultimately led to him becoming a technology journalist. Some of his other interests include Photography, Hand Lettering, and Digital Typography. Rajat is also somewhat obsessed with wrist-worn timepieces and appreciates a Casio just as much as a Jaeger-LeCoultre.