Solar + Wind Finance & Investment

March 16 - 19, 2025

Arizona Biltmore, LXR Hotels & Resorts

Phoenix, AZ

Registration is Now Open!

Due to extremely high demand, guest room reservations at the event venue are exclusively limited to registered participants on a first-come, first-served basis. Booking information will be provided immediately in your registration confirmation email.

For additional registration questions, please visit our FAQs page.

Do You Need to Network with Key Players in the Renewable Industry? We’ve Got You Covered.

Infocast’s Solar + Wind Finance & Investment Summit in 2024 gathered an unprecedented number of leading industry players to network, make deals, and get fully briefed on the renewables markets. This exceptional event is back to once again gather a who’s who for phenomenal deal-making and strategizing opportunities.

Join us for 2025's summit March 16-19, with an exclusive pre-summit evening of keynote sessions followed by a can't-miss welcome reception on March 16. Mark these dates and get ready for the most powerful networking place for top-level renewables and financial executives and capitalize on today’s booming renewables market!

Two years into the Inflation Reduction Act and the industry is adapting to expanded tax credits and the new tax credit sales market with vigor, as inflation is easing and interest rates are poised to lower. However, tariff concerns, transmission and interconnection reforms, and the national election are introducing uncertainty into plans and expectations industry-wide.

This is a critical year to attend Solar + Wind Finance & Investment Summit for a deep dive into today's challenges affecting valuation assumptions and how financing is incorporating new structures and risks. You’ll get insider tips on how to successfully navigate these waters, capitalize on the booming opportunities of the future, handle the lingering difficulties of the present, and meet everyone you need to know to take maximum advantage of your opportunities to develop, finance, and invest in today’s renewable energy projects.

Mingle with other C-Suite executives at the preeminent networking event for leaders in finance, solar, wind, and storage, top-rated by attendees as the place where deals and valuable business connections are made. Get the latest update on the finance and investment landscape, gain prescient insights into market trends, and network with the “highest quality of industry participants on the conference circuit.”

Bump into all the right people at the premier source of information for shaping your organization’s strategic direction – Let’s reconnect once again!

On-Site Badge Requirement Policy

With over 3,200 participants in 2024, we received an incredible amount of feedback and we are working diligently to make 2025 even better! Our top priority is to ensure that you have a safe and enjoyable experience.

We plan to implement several security measures and guidelines during the event, and badges will be required to be worn at all times. This will help security personnel stationed throughout the property to identify authorized attendees and ensure a smooth entry process to networking areas. All conference activities and access throughout the property will be restricted to badge holders only.

We firmly believe that that this proactive approach will significantly enhance the overall experience and enhance the networking-focused atmosphere you have come to expect from our events.

Get visibility for your brand

Lawrence SilversteinDirector of Sponsorship

[email protected]

Share your expertise

Peggy FranzinoVice President

[email protected]

Need help with registration?

Visit our FAQs page, ask our virtualassistant, or contact us at

[email protected]

Connect with top

industry professionals from around the country

Establish connections with

senior-level developers,

investors and financiers

Get deals done for 2025 and beyond in the post-IRA business environment

Gain valuable insights into

the latest project developments

and opportunities

Hear from experts with cutting-edge intelligence on the outlook

of tomorrow’s markets

Learn about

upcoming projects and

strategic opportunities

SCENES FROM THE 2024 SUMMIT

2024 RECAP

3200+

Event Participants

165+

Speakers & Panelists

35+

Sessions

200+

Sponsors & Exhibitors

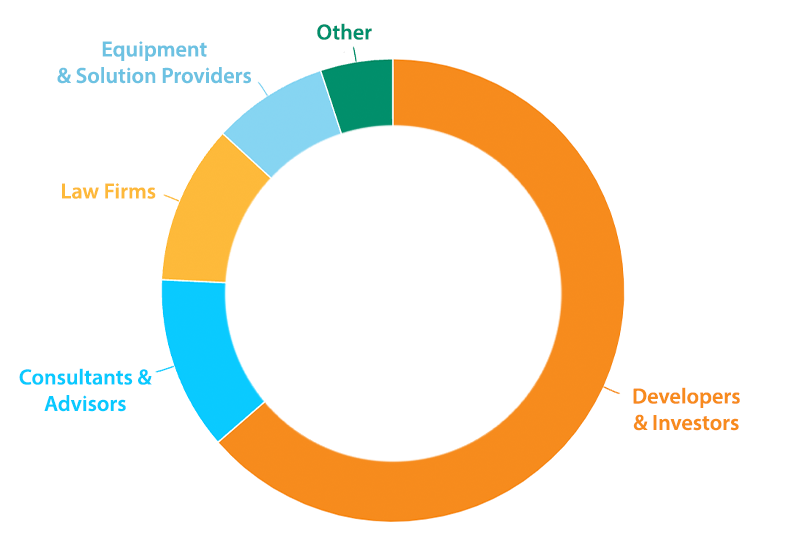

WHO SHOULD ATTEND?

- Renewables & Storage Developers

- Banks & Investors

- Alternative Finance Providers

- EPCs/Equipment Suppliers

- Law Firms

- Insurance Companies

- Consultants & Advisors

- All Industry Stakeholders

VENUE

Host Hotel

Arizona Biltmore, LXR Hotels & Resorts

2400 E Missouri Avenue

Phoenix, Arizona 85016

Due to extremely high demand, guest room reservations at the event venue are exclusively limited to registered participants on a first-come, first-served basis. Booking information will be provided immediately in your registration confirmation email.

WARNING: Please do not book any guest rooms with third-party housing companies for this event. Infocast does not partner with outside housing companies, so we advise that you only book guest rooms directly through the hotel.

We understand that the remaining rooms at the host hotel are very limited and there may be no availability when you receive your booking link. We have provided the following list of nearby hotels to assist you in securing a reservation. We cannot guarantee availability at these hotels. There are a number of hotels in close proximity to the Arizona Biltmore and the following is not an exhaustive list.

Partner Hotels

Limited availability at special group rates. Booking information will be provided in the registration confirmation email.

The Camby, Autograph Collection

2401 E Camelback Rd, Phoenix, AZ 85016

(602) 468-0700

Embassy Suites by Hilton Phoenix Biltmore

2630 E Camelback Road, Phoenix, AZ 85016

(602) 955-3992

Hilton Phoenix Resort at The Peak

7677 N 16th Street, Phoenix, AZ 85020

(602) 997-2626

Nearby Hotels

No special group rates available, based on current available rates.

AC Hotel by Marriott Phoenix Biltmore

2811 E Camelback Rd, Phoenix, AZ 85016

(602) 852-6500

Homewood Suites by Hilton Phoenix-Biltmore

2001 E Highland Ave, Phoenix, AZ 85016

(602) 508-0937

Omni Scottsdale Resort & Spa at Montelucia

4949 E Lincoln Dr, Scottsdale, AZ 85253

(480) 627-3200

Sanctuary Camelback Mountain,

A Gurney's Resort & Spa

5700 E McDonald Dr, Paradise Valley, AZ 85253

(855) 421-3522

Sonesta Select Phoenix Camelback

2101 E Camelback Rd, Phoenix, AZ 85016

(602) 955-5200

Extended Stay America - Phoenix - Biltmore

5235 N 16th St, Phoenix, AZ 85016

(602) 265-6800

Mountain Shadows Resort

5445 E Lincoln Drive, Phoenix, AZ 85253

(855) 485-1417

JW Marriott Scottsdale Camelback Inn

Resort & Spa

5402 E Lincoln Dr, Scottsdale, AZ 85253

(480) 948-1700

Hampton Inn Phoenix-Biltmore

2310 E Highland Ave, Phoenix, AZ 85016

(602) 956-5221

The Hermosa Inn

5532 N Palo Cristi Rd, Paradise Valley, AZ 85253

(602) 955-8614

Royal Palms Resort and Spa

5200 E Camelback Rd, Phoenix, AZ 85018

(602) 283-1234

The Phoenician, a Luxury Collection Resort, Scottsdale

6000 E Camelback Rd, Scottsdale, AZ 85251

(480) 941-8200

*Please note, Infocast does not have any guest room waiting lists and we do not have knowledge on each hotel's availability. Participants are required to contact hotels directly to arrange room reservations. Due to extremely high demand, guest room reservation at the host venue and partner hotels are limited to registered participants on a first come, first served basis. The event venue will not accept any reservations prior to the registration opening.

*You must be registered or be a confirmed sponsor in order to obtain the online room booking information at the host hotel and partner hotels. Registrants will receive room booking information in the registration confirmation email immediately following sign-up.*

Information Forecast, Inc. is permitted to audit all room reservations over the Solar + Wind Power Finance & Investment Summit 2025 dates. Any hotel reservation at the host hotel and partner hotels that does not match a conference registration (name and email) will be subject to cancellation. Information Forecast, Inc. is not responsible for any guest room cancellation fees or no-show charges billed by the Arizona Biltmore Hotel or partner hotels or nearby hotels. Furthermore, it is the responsibility of the participant to know the hotel cancellation policy before booking the room as hotel cancellation will vary between hotels. Information Forecast, Inc., the Arizona Biltmore Hotel and listed partner and nearby hotels cannot guarantee reinstatement of a canceled hotel reservation.

**WARNING: Please do not book any guest rooms with 3rd Party Housing Companies for this event. Infocast does not partner with outside housing companies, so we advise that you only book guest rooms at the hotel using the details provided above.**

Sponsors

Founding Sponsor

Summit Sponsor

Summit Sponsor

Summit Sponsor

Summit Sponsor

Summit Sponsor

Summit Sponsor

Summit Sponsor

Summit Sponsor

Summit Sponsor

Summit Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader

Thought Leader Sponsor

Thought Leader Sponsor

Thought Leader Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Premier Sponsor

Badge Sponsor

Event App Sponsor

Keycard Sponsor

Property Map Sponsor

Registration Sponsor

WiFi Sponsor

Luncheon Presenting Sponsor

Luncheon Co-Sponsor

Reception Presenting Sponsor

Hospitality Sponsor

Hospitality Sponsor

Hospitality Sponsor

Hospitality Sponsor

Hospitality Sponsor

Hospitality Sponsor

Hospitality Sponsor

Hospitality Sponsor

Hospitality Sponsor

Registration

Exclusive room booking instructions and link will be provided in your registration confirmation email. Due to high demand, rooms at the host venue and Infocast partner hotels are available on a first-come, first-served basis.

For Regulated Utility, Corporate Energy Buyer, CCA, NGO and Academic pricing, please click here.

*Discounts cannot be retroactively applied to an existing registration.

Need help with registration?

Contact us at: [email protected] | (818) 888-4444