Wool Market Size

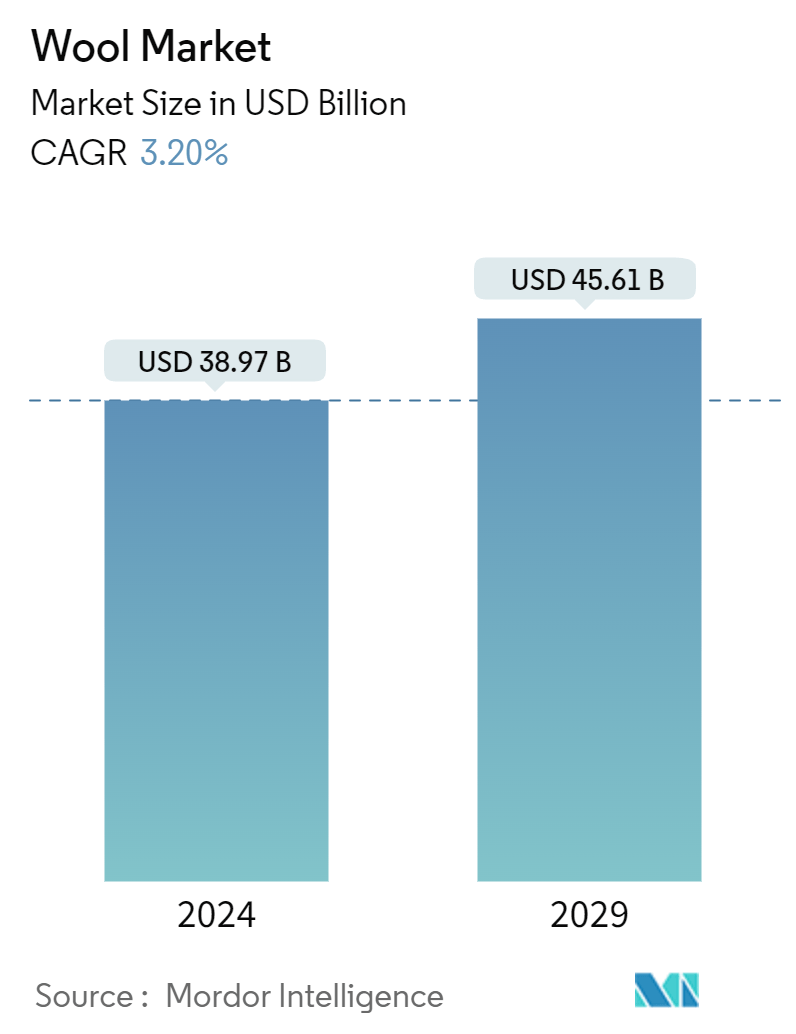

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 38.97 Billion |

| Market Size (2029) | USD 45.61 Billion |

| CAGR (2024 - 2029) | 3.20 % |

| Fastest Growing Market | Europe |

| Largest Market | Asia-Pacific |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Wool Market Analysis

The Wool Market size is estimated at USD 38.97 billion in 2024, and is expected to reach USD 45.61 billion by 2029, growing at a CAGR of 3.20% during the forecast period (2024-2029).

Wool is an intricate natural fiber procured from the fleece of sheep. Wool sheep are classified as Ovis aries aries. Merino, Rambouillet, Blue-Faced Leicester, and Corriedale breeds are among the best-known wool sheep. There are projected to be more than 1,000 different breeds of sheep across the world. Wool is a versatile natural fiber and can be made into a wide range of woven or knitted fabrics. Depending on the length and fiber diameter (fineness) of fleece, it can be processed through either the woolen or worsted processing system. Worsted-spun knitted fabrics are super-soft, incredibly versatile knits for baby clothes, underwear, t-shirts and sportswear, leggings, dresses, and other lightweight knitwear.

With technological advancements in the wool manufacturing industry, there is a rapid development of spinning and weaving tools, which has led to increased sales of clothing across the world. For instance, in November 2022, Savio announced the launch of a new automatic winding machine, Proxima Smartconer, in the Indian market. Such innovations are projected to increase productivity. Over the long term, growth opportunities mainly lie with millennial consumers whose purchasing behavior, such as the preference for quality, authenticity, and transparency, is driving the wool market.

Various measures undertaken by the IWTO, a regulating authority for wool quality and traceability, are fetching higher prices for wool, thus encouraging production. According to the International Wool Textile Organization (IWTO), 50.0% of the weight of the wool is pure organic carbon. The factor driving the demand for wool is the increasing domestic consumption of luxury wool textiles in countries such as China, the United States, and Europe. Moreover, the biodegradable quality of wool is also supporting the market. Wool is a natural decomposer since it is biodegradable and provides less harm to the environment. In addition, wool has thermal insulation properties, making it suitable for consumers.

Wool Market Trends

Institutional Efforts are Bolstering the Quality and Production of Wool

Wool can be used for different purposes, depending on the coarseness of the fiber and other characteristics such as fiber length and crimp. Very fine wool is primarily used for clothing, while coarser wool is used in carpets and furnishings such as curtains or bedding. Some sheep breeds are raised for their meat, while others are raised for their wool and sometimes for both. Texel and Dorset breeds are good choices for meat production. Merino, Rambouillet, Blue-Faced Leicester, and Corriedale breeds are among the best-known wool sheep. The momentum gained by government initiatives and marketing strategies of prominent textile players led to higher usage of wool in the textile and other industries. To ensure transparency and quality and to facilitate the flow of information about wool to assure buyers of the qualities being purchased, institutions like IWTO have developed many traceability systems. One such system is the National Wool Declaration Integrity Program. The National Wool Declaration is an industry initiative recognized globally for its transparency and traceability from the farm. The NWD Integrity Program (NWD-IP) is an extensive program of desktop audits and on-farm inspections to build a wool pipeline and consumer confidence in Australian wool. With all these initiatives put forth by the regulating authority, wool is fetching a higher price because sheep rearing for wool is also increasing.

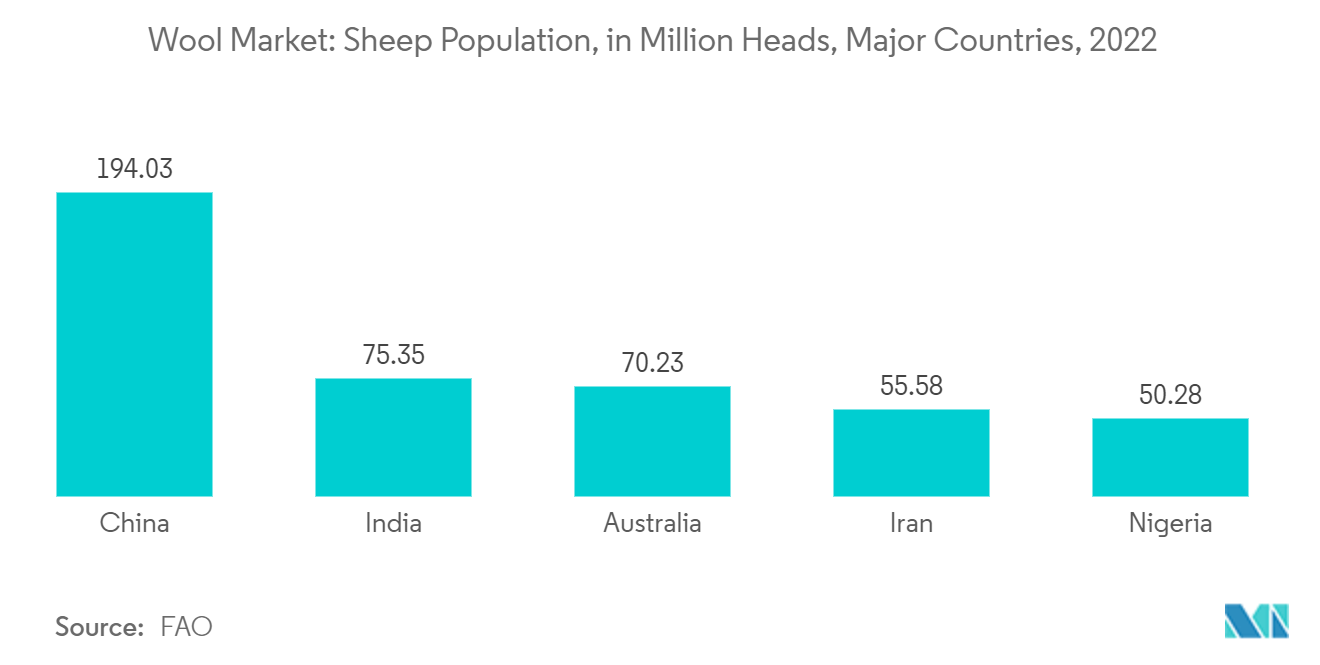

According to the FAO, the global sheep numbers in 2022 rose to 1.296 billion heads, up by 8.65 million from 2021. China has the largest sheep population, followed by India and Australia. According to the IWTO, greasy wool production rose by 1.1% in 2022, to 1,977.3 mkg, following a 1.7% increase in 2021. The global wool production in clean weight terms increased by 15,600 metric tons or 1.5% to an estimated 1,051.2 mkg clean in 2022. Thus, the increasing sheep population and the institutional initiatives to ensure quality are projected to boost wool production during the forecast period.

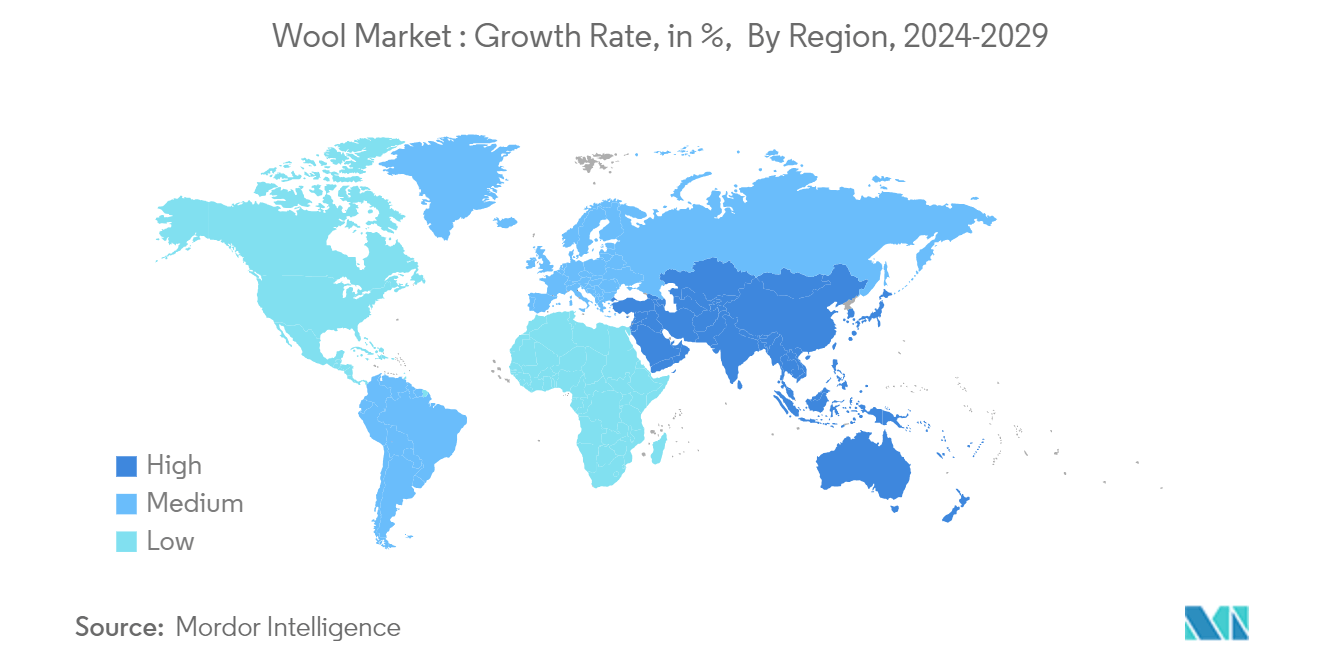

Asia-Pacific is Expected to Dominate the Market

Wool is a commodity traded globally, and its diversity in the market is vast and ever-evolving. With most of the wool sold with an IWTO Test Certificate, the buyer's confidence in quality is guaranteed. Asia-Pacific is dominating the wool market with high production and exports. According to the FAO, Australia, China, and New Zealand are the major wool producers. According to the ITC Trademap, in 2020, Australia accounted for the highest exports, worth USD 1,595,320 thousand, followed by China, accounting for exports worth USD 1,543,868 thousand in 2020, contributing 36.2% of the total exports.

India exports woolen yarn fabrics, hand-made carpets, and ready-made garments to Italy, South Korea, the United Kingdom, the United States, Sri Lanka, Germany, Australia, the United Arab Emirates, Sweden, the Netherlands, Oman, Afghanistan, and Tanzania, among others. The United States is a major importer of woolen products from India, with exports valued at USD 855.6 million in 2020-2021. Woolen fabrics are mainly exported to Italy, South Korea, the United Kingdom, the United States, Sri Lanka, Germany, and Australia. During 2020-2021, these countries imported INR 513.9 crore (USD 64.5 million) worth of yarn fabrics from India, representing a share of 64% of the total yarn exports. Italy was the major importer during the same period at 17.5%.

According to the ITC Trademap, in 2021, the trade value of wool exported from Australia to China amounted to about USD 1.9 billion. This was the highest trade value of wool exported from Australia that year. Australia is the leading global supplier of wool and the world's largest wool export nation, accounting for 39% of global wool exports. Given the dominance of fine Merino production in Australia, Australian wool is typically retailed as high-end fashion and lightweight knitwear. With the trend toward eco-friendly, sustainable, and biodegradable parameters in the Asia-Pacific apparel industry, the demand for wool is growing as it provides comfort. Therefore, the growing consumption of wool among various population groups and favorable production through sheep breeds support the segment's growth during the forecast period.

Wool Market News

- June 2023: Lion Brand Yarn acquired Quince & Co., a Maine-based premium hand-knitting yarn company in the United States focused on creating yarns with products for farmed natural and renewable fibers.

- August 2022: The Ministry of Textiles approved the Pashmina Wool Development Scheme under the Integrated Wool Development Programme (IWDP) with a budget allocation of INR 29.25 crore (USD 3.5 million) for implementation during FY from 2021-22 to 2025-26 for the procurement and marketing of Pashmina wool in Jammu and Kashmir and Ladakh.

Wool Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.3 Market Restraints

4.4 Value Chain Analysis

5. MARKET SEGMENTATION

5.1 Geography (Production Analysis, Consumption Analysis by Value and Volume, Import Analysis by Value and Volume, Export Analysis by Value and Volume, and Price Trend Analysis)

5.1.1 North America

5.1.1.1 United States

5.1.1.2 Mexico

5.1.2 Europe

5.1.2.1 Germany

5.1.2.2 Belgium

5.1.2.3 United Kingdom

5.1.2.4 Italy

5.1.2.5 Netherlands

5.1.2.6 Turkey

5.1.3 Asia-Pacific

5.1.3.1 China

5.1.3.2 India

5.1.3.3 Japan

5.1.3.4 Australia

5.1.3.5 New Zealand

5.1.4 South America

5.1.4.1 Brazil

5.1.4.2 Argentina

5.1.5 Middle East and Africa

5.1.5.1 UAE

5.1.5.2 Saudi Arabia

5.1.5.3 Oman

5.1.5.4 Morocco

6. MARKET OPPORTUNITIES AND FUTURE TRENDS

Wool Industry Segmentation

Wool is the textile fiber from sheep and other mammals, especially goats, rabbits, and camelids. The wool market is segmented by geography into North America, Europe, Asia-Pacific, South America, and Middle East and Africa. The report includes production analysis (volume), consumption analysis (value and volume), export analysis (value and volume), import analysis (value and volume), and price trend analysis. The report offers the market size and forecasts regarding volume (metric tons) and value (USD) for all the above segments.

| Geography (Production Analysis, Consumption Analysis by Value and Volume, Import Analysis by Value and Volume, Export Analysis by Value and Volume, and Price Trend Analysis) | ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

Wool Market Research FAQs

How big is the Wool Market?

The Wool Market size is expected to reach USD 38.97 billion in 2024 and grow at a CAGR of 3.20% to reach USD 45.61 billion by 2029.

What is the current Wool Market size?

In 2024, the Wool Market size is expected to reach USD 38.97 billion.

Which is the fastest growing region in Wool Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Wool Market?

In 2024, the Asia-Pacific accounts for the largest market share in Wool Market.

What years does this Wool Market cover, and what was the market size in 2023?

In 2023, the Wool Market size was estimated at USD 37.72 billion. The report covers the Wool Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Wool Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

What are the key growth opportunities in the Wool Industry?

The key growth opportunities in the Wool Industry are a) Rising demand for sustainable and eco-friendly textiles b) Increasing use of wool in home textiles, furniture upholstery, and technical applications like insulation

What are the key growth opportunities in the Wool Industry?

The key growth opportunities in the Wool Industry are a) Rising demand for sustainable and eco-friendly textiles b) Increasing use of wool in home textiles, furniture upholstery, and technical applications like insulation

Wool Industry Report

The woolen industry is on a significant growth path, with advancements in wool production techniques and a shift towards sustainable and ethical practices. Driven by millennial consumers' demand for quality, authenticity, and eco-friendliness, the global market for wool is expected to see continued expansion. The production of wool is receiving a boost from regulatory bodies enforcing quality and traceability measures, alongside a growing sheep population to meet worldwide demand. The Asia-Pacific region, particularly Australia, China, and New Zealand, is leading in wool production and export, highlighting a global trend towards eco-friendly and comfortable woolen products. Online retail channels are gaining importance, indicating shifts in consumer purchasing behaviors. For detailed insights into wool market share, size, and revenue growth, Mordor Intelligence™ provides comprehensive analysis and forecasts, available for download as a free PDF report, spotlighting this industry's future trends and opportunities.