Trump to impose 25% to 100% tariffs on Taiwan-made chips, impacting TSMC

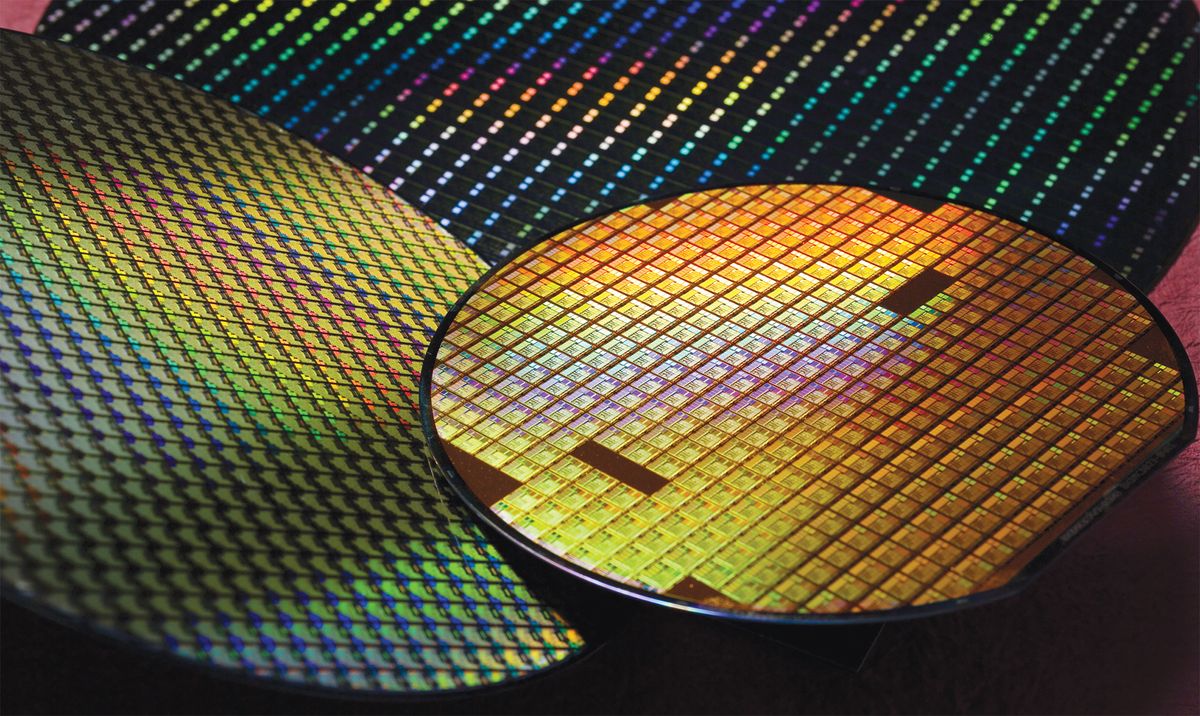

U.S. President Donald Trump announced plans Monday night to impose massive tariffs on Taiwan-made chips in an attempt to incentivize companies to relocate production to the United States. On the one hand, this could reduce American companies' reliance on Taiwan in general and TSMC in particular. On the other hand, building a semiconductor fab takes three to four years, so the effect of production moving to the US due to tariffs may not be felt for some time.

"In the very near future, we are going to be placing tariffs on foreign production of computer chips, semiconductors, and pharmaceuticals to return production of these essential goods to the United States," Trump told House Republicans conference (via C-Span.org). "They left us and went to Taiwan; we want them to come back. We do not want to give them billions of dollars like this ridiculous program that Biden has given everybody billions of dollars. They already have billions of dollars. […] They did not need money. They needed an incentive. And the incentive is going to be they [do not want to] pay a 25%, 50% or even a 100% tax."

They left us and went to Taiwan. We want them to come back.

Donald Trump

Trump criticized leading U.S. tech companies, such as Apple, AMD, Broadcom, Nvidia, and Qualcomm, for building their processors at TSMC in Taiwan. He emphasized that the proposed tariffs would leave companies with no choice but to invest in domestic production facilities to avoid high taxes. He also argued that government grants like the CHIPS Act are unnecessary and counterproductive and that companies should use their own resources to build fabs rather than rely on public funding.

However, fabs take years to build, and a leading-edge fab costs tens of billions of dollars. Even if TSMC were to start constructing a sub-2nm-capable fab in the U.S. today, it would come online only in 2028–2029. Assuming that Trump’s administration imposes tariffs on ASICs, CPUs, GPUs, and other types of chips made in Taiwan in the coming weeks, this would make PCs, servers, and smartphones more expensive for companies and individuals in the U.S. immediately, which will hardly serve the U.S. economy well. To avoid this, the administration would need to introduce exemptions, just like it did with China-made graphics cards and motherboards years ago.

Still, tariffs and exemptions are good leverage to make companies like Apple, AMD, Nvidia, and TSMC invest in America and build a significant percentage of their chips in the U.S. For now, TSMC has only one small fab in the U.S. and is building two additional modules. Perhaps the company will have to review its plans for the next four years. Still, chips made in the U.S. are more expensive than chips made in Taiwan.

The proposed tariffs mark a significant shift in U.S. trade policy, signaling an aggressive stance to curb dependence on foreign manufacturing and prioritize domestic production, but it remains to be seen how well this strategy will work.

Stay On the Cutting Edge: Get the Tom's Hardware Newsletter

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

bit_user Building fabs in the USA is going to become a lot more expensive, once Denmark slaps export taxes on ASML machines (esp. if this Greenland business escalates). After accounting for that, a lot of companies might feel the import tariffs on TSMC chips aren't quite so unpalatable.Reply -

hotaru251 Reply

will 100% raise price cause of tariffs.beyondlogic said:mean while nvidia will make up some market bs for raising card prices due to tarriff war ( joke but possible lol)

Tariffs are the consumers tax as the shop aint losing the $.

Nvidia was already whining about the restrictions to sell stuff in other countries and this is in a similar thign as it impacts literally everything they sell not just in other countries. -

bit_user Reply

Once the stock market crashes, I think some of these policy positions will shift to ones that are much less painful.LibertyWell said:Bring on the pain.

Not sure about the prospect for gains, due to the turmoil trade wars create among global supply chains. We had a taste of that, back in 2021-2022. It's not feasible to produce everything domestically. -

TechieTwo Tariffs are used to level the economic playing field and encourage production and jobs in a country. TSMC can easily just finish segments 2 and 3 in the U.S. to produce all the chips needed. If Intel ever gets their act together they could expand U.S. production also.Reply -

spongiemaster Reply

Nvidia won't be paying the tariffs, except maybe on the FE models. Tariffs are a tax levied at US borders. Whoever is importing the product into the US will be responsible for paying the tariff which will be passed on to the consumer.beyondlogic said:someone might be slapping trump now lol. mean while nvidia will make up some market bs for raising card prices due to tarriff war ( joke but possible lol) -

ohio_buckeye It’s a good incentive to get more things built in the USA. If 2020 taught us anything it should be that things which are critical at least should be made domestically. Let’s say an event such as a war happens for example, you don’t want to be at someone’s mercy because you don’t have chips for your missiles, military vehicles or parts for your electric grid for example.Reply

I do like the idea though if he does abolish the IRS as he’s saying then I’ll have more money to pay the higher cost. And if the prices on fuel, food etc begin to come down, I’ll save money in some of those areas anyway. -

George³ "Will" or "to be" means it is still to happen sometime in the future, not right now. Does anyone here have any idea when (at least relatively) exactly it will happen?Reply -

V8VENOM Reply

You mean pay US labor 50X more than cheaper labor from externals? How could that possibly be a benefit in any sense? Price of everything is going to skyrocket 300% inflation. What do you think US "core" companies are going to do? Pay US labor 50X more or automate everything and build on AI to replace all labor because it's much cheaper to build machines.PiersPlowman said:strategic view of retaining core interests -

PiersPlowman Reply

Any rapid or exorbitant price increases will not be sustainable in the long term. If it means forcing more life out of existing systems, so be it.V8VENOM said:You mean pay US labor 50X more than cheaper labor from externals? How could that possibly be a benefit in any sense? Price of everything is going to skyrocket 300% inflation. What do you think US "core" companies are going to do? Pay US labor 50X more or automate everything and build on AI to replace all labor because it's much cheaper to build machines.

And you are forgetting, the Chicoms get a vote in this, too. If TSMC were to have a <cough> change of ownership <cough>, then prices could get really volatile indeed.